Auto insurance claim process: A detailed guide of the top 10 companies

It can be challenging to file an auto insurance claim, especially when you’re already dealing with stress from an accident. However, being aware of the claims procedure before you need it might be quite beneficial. You can file more easily, avoid common mistakes, and get your compensation easily. We’ll examine how the top 10 auto insurance companies handle claims in this article, covering everything from filing choices to typical processing times that set each company apart.

Why understanding the insurance claims process matters?

How easily and quickly your claim is resolved after an accident can be significantly impacted by how your insurance handles claims . Every insurance provider has its own policies, with different deadlines, documentation needs, and customer support services. According to industry data, it usually takes two to four weeks to resolve an insurance claim. However, the accident’s complexity and how organized you are when filing a claim depend on your insurance policy. The process will go more quickly and stress-free if you are better prepared.

Is Your Current Auto Insurance Right for You?

It’s key to review your current auto insurance policy before looking into how each insurance provider handles claims. By knowing what your insurance covers and what it does not when an accident occurs, you can determine your level of protection.

The Basic Insurance Claims Process: What to Expect

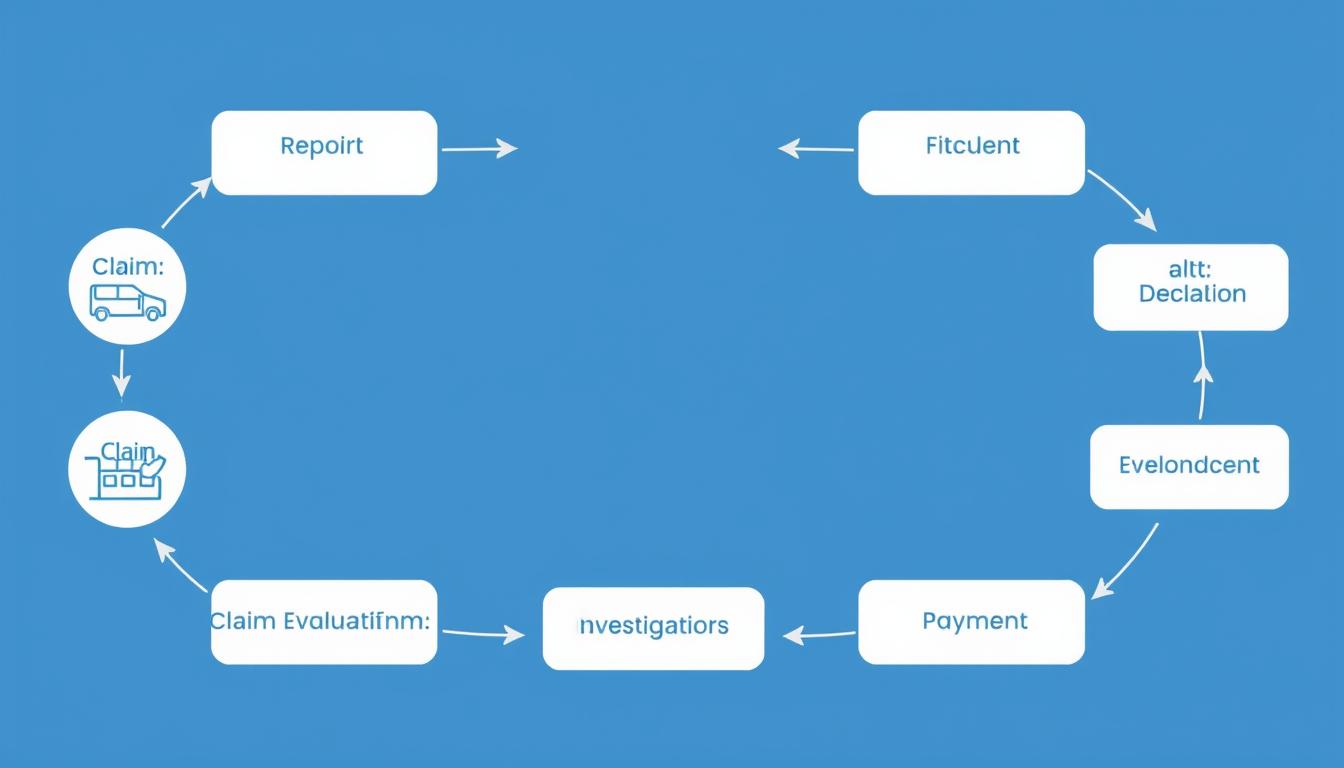

While each insurance company has its unique method, most auto insurance claims follow a similar step-by-step procedure. Being prepared can help you remain calm and organized if you ever have to file a claim.

- Report the accident to your insurance company as soon as possible

- Document the damage with photos, videos, and notes

- File a claim through your insurer's preferred method (app, phone, online)

- Claim investigation by an insurance adjuster

- Damage evaluation and cost estimation

- Claim resolution and settlement offer

- Payment for repairs or replacement

The effectiveness and overall customer experience during these stages can differ significantly among insurers. Let’s examine which of the top ten auto insurance companies best suits your needs.

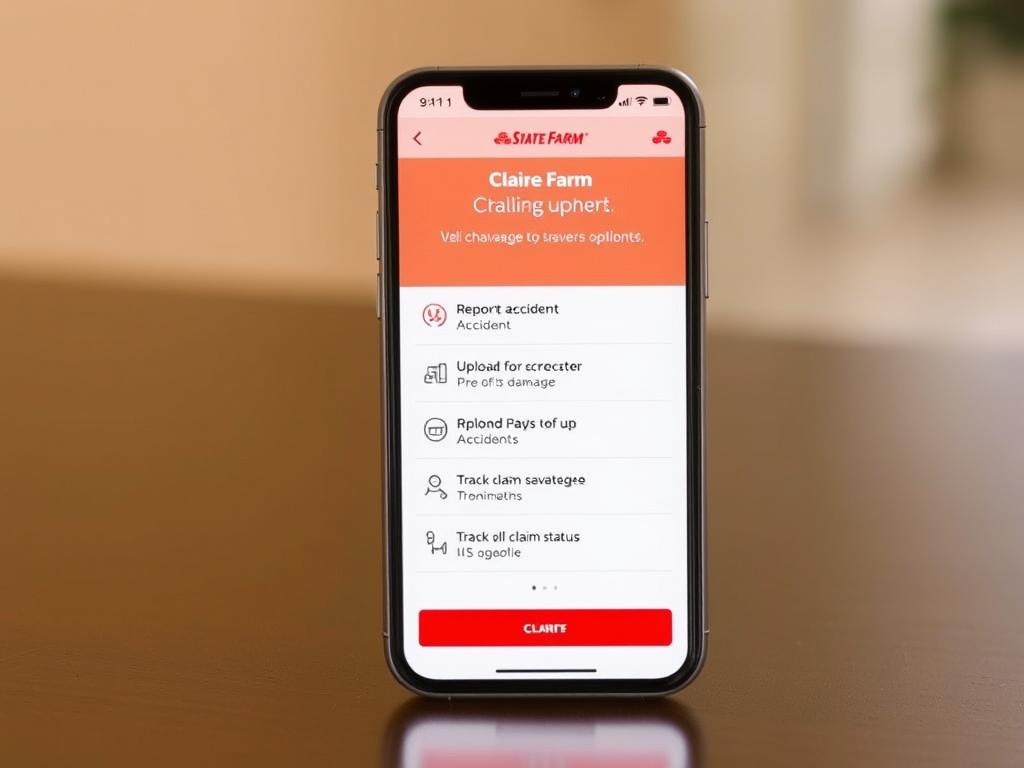

State Farm Insurance Claims Process

Step-by-Step Breakdown

State Farm makes it easy and straightforward to file an auto insurance claim by offering a number of options to report an accident. Using the State Farm mobile app, visiting their official website, or calling 1-800-STATE FARM, and speaking with your local State Farm agent directly.

Filing Options:

Average Resolution Time:

State Farm typically resolves straightforward claims within 7-14 days, though complex claims may take longer.

Unique Features:

Pros: Strong local agent support Comprehensive mobile app High customer satisfaction ratings

Cons: May be slower for complex claims Higher than average premiums Repair network may be limited in some areas

Geico Insurance Claims Process

Step-by-Step Breakdown

GEICO prioritizes claim processing digitally, providing a smooth experience via their online portal and mobile app. Customers can check their claim processing, review policy management, file a claim anytime, and monitor the claim status from their mobile app. This advanced technology reduces documentation process and speeds up the claim processing.

Filing Options:

Average Resolution Time:

GEICO typically takes 5-10 days for normal claim processing, and complex claims take time depending on the documentation and third-party involvement.

Unique Features:

Pros: Fast digital claim processing Advanced mobile app tools Quick photo estimates

Cons: Less personalized service Limited in-person support Some customers report communication issues.

Progressive Insurance Claims Process

Step-by-Step Breakdown

Progressive distinguishes itself with its concierge claims service, which simplifies the process as much as possible. Their customer approach focuses on convenience and peace of mind.

Filing Options:

Average Resolution Time:

Progressive typically takes 7-14 days to resolve the claim with their concierge claim service.

Unique Features:

Pros: Concierge service simplifies process Rental car arrangements handled directly Good digital tools

Cons: Service centers not available in all areas Some customers report initial settlement offers being low Communication can be inconsistent

Top 10 Auto Insurance Claims Process Comparison

| Insurance Provider | Filing Methods | Avg. Resolution Time | 24/7 Support | Mobile App Quality | Customer Satisfaction |

|---|---|---|---|---|---|

| State Farm | App, Online, Phone, Agent | 7-14 days | Yes | 4.3/5 | |

| Geico | App, Online, Phone, Virtual | 5-10 days | Yes | 4.6/5 | |

| Progressive | App, Online, Phone, Concierge | 7-14 days | Yes | 4.2/5 | |

| Allstate | App, Online, Phone, Agent | 10-14 days | Yes | 4.0/5 | |

| USAA | App, Online, Phone | 5-7 days | Yes | 4.8/5 | |

| Liberty Mutual | App, Online, Phone | 7-14 days | Yes | 3.9/5 | |

| Farmers | App, Online, Phone, Agent | 10-15 days | Yes | 3.7/5 | |

| Nationwide | App, Online, Phone, Agent | 8-14 days | Yes | 4.0/5 | |

| Travelers | App, Online, Phone, Agent | 10-15 days | Yes | 4.2/5 | |

| American Family | App, Online, Phone, Agent | 7-14 days | Yes | 4.2/5 |

Ready to Compare Auto Insurance Options?

Understand how various providers handle claim; you can review your current coverage policy or explore new options.

Key Documentation Differences Between Providers

All insurance providers require basic accident information; their specific documentation can differ greatly. You can keep organized and prevent delays in the claim process by being aware of these differences.

Basic Requirements (All Providers)

Additional Requirements (Some Providers)

Digital Submission Options

Pro Tip: Documentation Preparation: Make a digital accident kit on your phone with your policy details, insurance contact information, and a brief list of things to record after an accident. This action guarantees you don’t miss any important detail while filing a claim, saves your time, and reduces your stress.

Deductible Policies and Payment Processes

Your entire claim process may be greatly impacted by how and when you pay your deductibles. Each insurance company has its own methods, which can impact your out-of-pocket expenses, repair delays, and even how quickly your vehicle gets back on the road.

Common Deductible Approaches

Pay Directly to Repair Shop

Providers: State Farm, Allstate, Farmers When your vehicle has been repaired, you pay your deductibles directly to the shop. The shop is then reimbursed by the insurance provider for the remaining charges.

Deducted from Settlement

Providers: Geico, Progressive, Liberty Mutual With this method the insurance company deducts your deductibles from the entire settlement amount before paying you.

Vanishing Deductibles

Providers: Nationwide, Allstate (optional) Safe drivers are rewarded with vanishing deductible programs, which lower your deductibles each year for claim-free driving, potentially eliminating it completely.

Deductible Waiver Situations

Some insurance companies waive your deductibles under specific situations:

- Not-at-fault accidents: USAA and State Farm may waive deductibles when another driver is clearly at fault.

- Windshield repair: Progressive and GEICO often waive deductibles for simple glass repair (not replacement).

- Total loss situation: Varies by provider, but some adjust deductible replacement.

- Multiple policy holders: If both drivers have the same insurance company

Insurance Consumer Advocate: Always ask your insurance provider about deductible options before filing a claim. For minor damage just above your deductible amount, it might be more cost-effective to pay out-of-pocket rather than risk a premium increase.

Actionable Tips to Streamline Your Insurance Claims Process

Regardless of the insurance company you select, these useful tips can help you handle the claim process more skillfully and possibly get a quicker, and smoother settlement. A little preparation before, during, and after an accident can significantly reduce the level of stress.

Before an Accident

During the Claims Process

Common Mistakes to Avoid

Using Technology to Your Advantage Most top insurers make managing claims easier than ever with advance mobile apps and digital tools. These apps typically include: Guided photo/video capture of damage GPS-enabled accident location recording Digital document submission Real-time claim status tracking Direct messaging with claims adjusters Getting yourself familiar with these insurance providers apps before an accident can significantly smooth your claim experience.

Frequently Asked Questions About the Insurance Claims Process

How much time do I have to submit a claim for auto insurance?

The majority of insurers demand that you report incidents “promptly” or “within a reasonable time”, however, state and company deadlines may differ. While some companies take a week, State Farm and Allstate typically ask for notification within 1-2 days. For precise deadlines, see your policy; if you wait too long, your claim may be rejected.

Do rates for auto insurance actually depend on credit scores?

Of course, in the majority of states. Insurance companies have discovered statistical correlations between credit score and claims likelihood. If you raise your credit score, many insurers reduce your premiums up to 20-50%. However in California, Hawaii, Massachusetts, and Michigan, using a credit score to determine an insurance rating is prohibited.

Can I choose my own repair shop, or must I use the insurance company’s recommended facility?

Regardless of what your insurer suggests, you are legally allowed to choose your own repair shop in most of the states. However, there are more benefits to choosing a provider’s approved shop, including direct invoicing, quick claim processing, and guaranteed repairs. Although GEICO, Progressive, and State Farm have vast networks of authorized stores, they still allow customer choice.

What happens if I don’t agree with the damage assessment made by the insurance adjuster?

By obtaining proof to back up your claims, you can dispute an adjuster’s assessment. This could include expert opinions, photos showing additional damage, and independent repair quotes. The majority of insurers have official appeals processes; USAA and American Family have the best ratings for fair dispute resolution. You can register a complaint with the insurance department in your state or think about using mediation services if informal negotiations don’t work out.

Navigating the Insurance Claims Process with Confidence

Being aware of how various auto insurance companies handle claims, you can make better coverage options and feel more prepared in the event of an accident. The top insurers combine user-friendly digital tools, responsive customer service, and fair settlement for a smoother experience for drivers, even though each company’s process is unique. Based on analysis: Although only military members and their families are eligible, USAA often rates first in terms of claims satisfaction. State Farm provides a great balance of digital ease and individual agent assistance. GEICO is distinguished by its quick claims processing and user-friendly mobile app. In the end, the best insurance claims process is the one you rarely need to use. Your best defense against the stress and expenses of auto accidents continues to be driving safely and keeping sufficient insurance.

Prepare Before You Need to File a Claim

Now is the time to access your current policy, learn about your coverage, and set up the digital tools that can make the claim process smoother and stress-free.