How to Find the Cheapest Bike Insurance in 2025: Top 10 Companies Compared

Finding affordable motorcycle insurance doesn't mean sacrificing quality coverage. Whether you ride a cruiser, sport bike, or touring motorcycle, getting the cheapest bike insurance requires understanding what factors affect your rates and which companies offer the best value for your specific situation. This comprehensive guide compares the top motorcycle insurance providers of 2025, breaking down rates by state, bike type, rider age, and coverage options. We'll reveal which companies consistently offer the lowest premiums and how you can leverage discounts to reduce your costs even further.

Top 10 Cheapest Motorcycle Insurance Companies of 2025

We've analyzed quotes from the leading motorcycle insurance providers across multiple states, bike types, and rider profiles to determine which companies consistently offer the lowest rates while maintaining good coverage options and customer service.

| Insurance Company | Average Monthly Premium | Best For | Customer Satisfaction |

|---|---|---|---|

| Dairyland | $22 | Daily riders, budget-conscious | |

| Progressive | $23 | Comprehensive coverage, discounts | |

| Harley-Davidson | $24 | Custom bikes, accessories | |

| Geico | $27 | Multi-policy bundling | |

| Nationwide | $34 | Comprehensive coverage options | |

| Allstate | $35 | Local agent support | |

| State Farm | $38 | Excellent customer service | |

| Markel | $40 | Specialized motorcycle coverage | |

| Safeco | $42 | Customizable policies | |

| Farmers | $24 | Comprehensive coverage options |

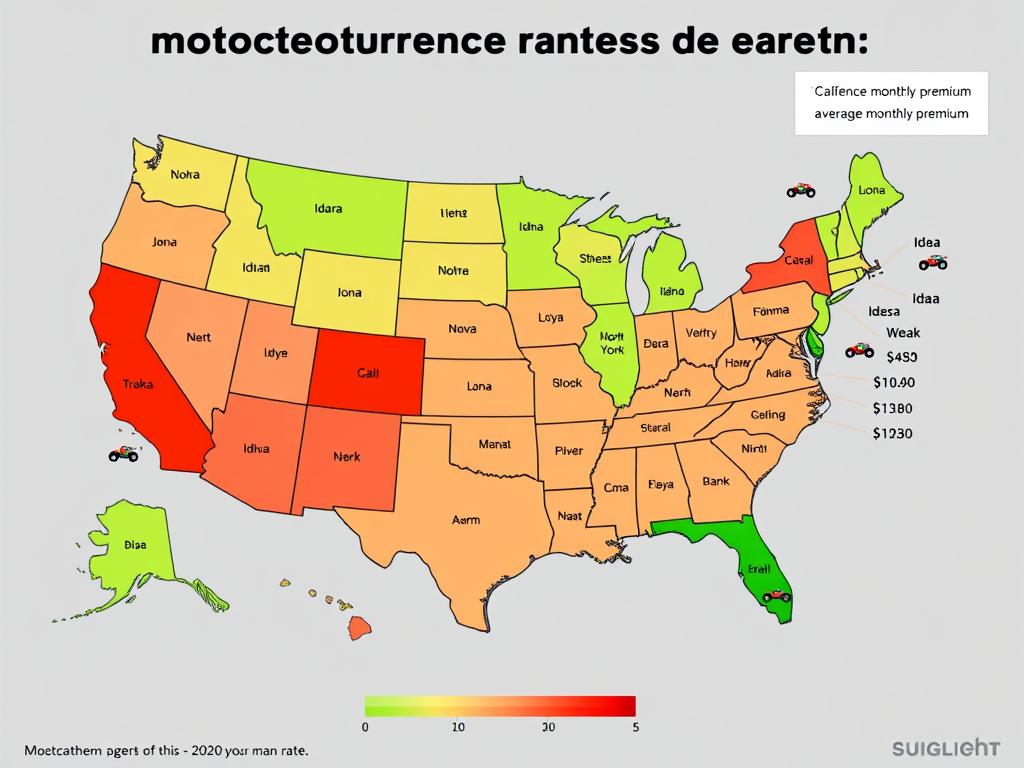

Cheapest Motorcycle Insurance by State

Insurance rates vary significantly by location due to differences in state laws, weather conditions, theft rates, and accident statistics. Here's how the cheapest motorcycle insurance providers compare across three major states:

| State | Cheapest Provider | Monthly Premium (Liability) | Monthly Premium (Full Coverage) |

|---|---|---|---|

| California | Harley-Davidson | $25 | |

| Texas | Dairyland | $18 | |

| Florida | Dairyland | $20 |

Why Rates Vary by State

Several factors contribute to the significant variations in motorcycle insurance rates across different states:

- State-specific insurance requirements and minimum coverage limits

- Weather conditions and length of riding season

- Population density and traffic congestion

- Theft rates and accident statistics

- Healthcare costs in the state (affects medical payment coverage)

Most Expensive States for Motorcycle Insurance

- California ($46/month average)

- Florida ($54/month average)

- New York ($43/month average)

- Kentucky ($69/month average)

- Louisiana ($58/month average)

How Bike Type Affects Your Insurance Rates

The type of motorcycle you ride significantly impacts your insurance premiums. Sport bikes typically cost more to insure than cruisers or touring bikes due to their higher accident rates and repair costs.

Cruisers

Cruisers typically have the lowest insurance rates due to their lower top speeds and accident statistics. These bikes are often ridden by more experienced riders who maintain clean driving records.

Average Monthly Premium: $18-25

Sport Bikes

Sport bikes have the highest insurance premiums due to their high performance capabilities, increased accident rates, and typically younger rider demographic. Insurance companies consider these bikes high-risk.

Average Monthly Premium: $35-80

Touring Bikes

Touring motorcycles fall in the middle range for insurance costs. While they're more expensive to replace, they're typically ridden by experienced riders who prioritize safety.

Average Monthly Premium: $25-40

Sample Annual Premiums by Bike Model

| Motorcycle Model | Category | Annual Premium (30-year-old rider) | Cheapest Provider |

|---|---|---|---|

| Honda Rebel 500 | Cruiser | $215 (liability only) | |

| Yamaha YZF-R6 | Sport | $780 (full coverage) | |

| Harley-Davidson Road Glide | Touring | $410 (full coverage) | |

| Kawasaki Ninja 400 | Sport | $520 (full coverage) | |

| BMW R 1250 GS | Adventure | $485 (full coverage) |

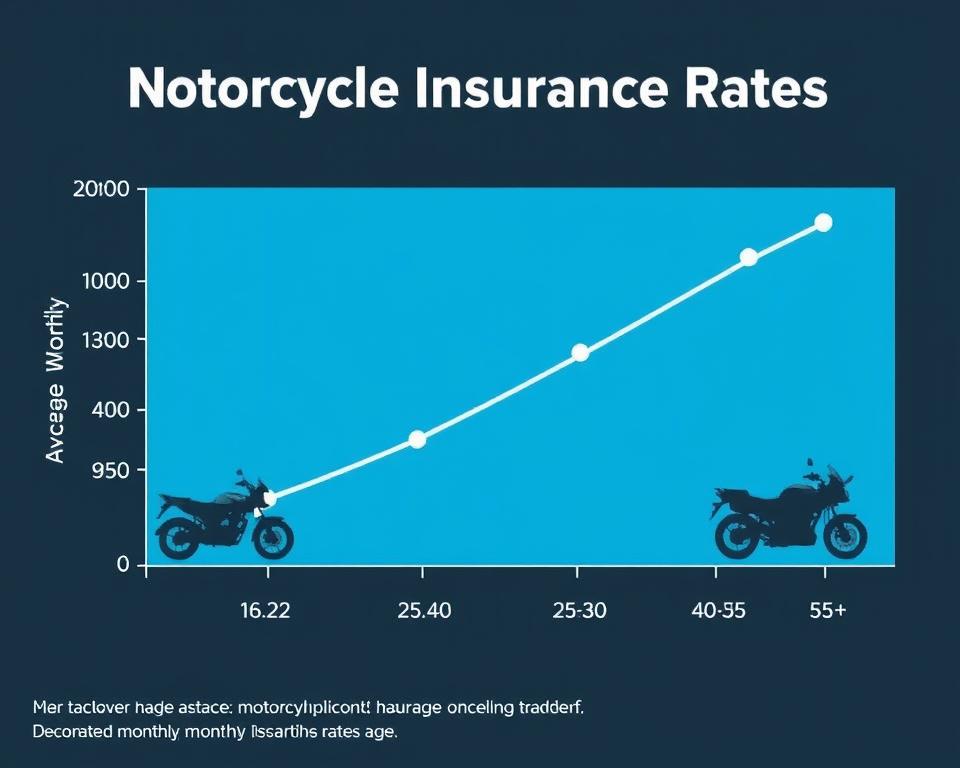

How Age Affects Motorcycle Insurance Rates

Rider age is one of the most significant factors affecting motorcycle insurance premiums. Younger riders typically pay substantially more due to their limited experience and higher risk profiles.

Under 25

Riders under 25 face the highest insurance rates due to their limited experience and higher accident statistics. Sport bike premiums can be particularly expensive for this age group.

Average Monthly Premium: $50-120

25-40

This age bracket sees significantly lower rates than younger riders. Insurance companies view this group as having a better balance of experience and responsible riding habits.

Average Monthly Premium: $25-60

40+

Riders over 40 typically enjoy the lowest insurance rates due to their extensive riding experience and more cautious approach to motorcycling.

Average Monthly Premium: $18-45

Coverage Options: Finding the Right Balance

Understanding different coverage tiers is essential for finding the cheapest bike insurance that still provides adequate protection. While liability-only policies offer the lowest premiums, they provide minimal protection.

Liability-Only Coverage

Covers damages you cause to others but provides no protection for your own bike. This is the cheapest option but leaves you financially vulnerable if your motorcycle is damaged or stolen.

Average Monthly Cost: $15-25

Full Coverage

Includes liability, collision, and comprehensive coverage. Protects against theft, vandalism, weather damage, and accidents regardless of fault. The most complete protection available.

Average Monthly Cost: $30-60

Sport Bike-Specific Policies

Specialized coverage for high-performance motorcycles with higher liability limits and specific protections for sport bike components and riding gear.

Average Monthly Cost: $40-100

What Does Full Coverage Include?

- Bodily Injury Liability: Covers injuries you cause to others

- Property Damage Liability: Covers damage you cause to others' property

- Collision Coverage: Repairs your bike after an accident regardless of fault

- Comprehensive Coverage: Protects against theft, vandalism, weather damage

- Uninsured/Underinsured Motorist: Covers you if hit by an uninsured driver

- Medical Payments/PIP: Covers your medical expenses regardless of fault

- Insurance Industry Expert: While liability-only coverage offers the lowest premiums, it provides no protection for your own motorcycle. For bikes valued over $5,000, the additional cost of full coverage is often worth the investment.

Maximizing Motorcycle Insurance Discounts

One of the most effective ways to secure the cheapest bike insurance is to take advantage of available discounts. Most major insurance providers offer multiple ways to lower your premium.

Safety Course Certifications

Completing an approved motorcycle safety course can reduce your insurance premium by 10-15%. These courses teach valuable riding skills while qualifying you for significant discounts.

MSF-Approved Programs

- Basic RiderCourse: 10-15% discount at most insurers

- Advanced RiderCourse: Additional 5% at select providers

- Street RiderCourse: Recognized by Progressive and Dairyland

- Military SportBike RiderCourse: Special discounts for military personnel

Provider-Specific Course Discounts

- Progressive: Up to 15% for MSF courses

- Dairyland: Up to 10% for any approved safety course

- Harley-Davidson: Up to 20% for H-D Riding Academy

- Geico: Up to 10% for safety course completion)

Usage-Based Insurance Programs

Several insurance companies now offer usage-based tracking programs that can significantly reduce premiums for safe, low-mileage riders.

| Program | Provider | Potential Savings | How It Works |

|---|---|---|---|

| Snapshot | Progressive | Up to 30% | |

| Drivewise | Allstate | Up to 25% | |

| SmartRide | Nationwide | Up to 40% |

Additional Discount Opportunities

Multi-Policy Discounts

Anti-Theft Devices

Payment Discounts

Actionable Tips to Lower Your Motorcycle Insurance Costs

Beyond choosing the right provider and maximizing discounts, there are several strategies you can employ to secure the cheapest bike insurance without sacrificing necessary coverage.

Understanding State Minimum Requirements

Each state has different minimum liability requirements for motorcycle insurance. While meeting only the minimum requirements will result in the cheapest premiums, it may leave you underprotected.

Sample State Minimums

- California: 15/30/5 ($15,000 bodily injury per person, $30,000 per accident, $5,000 property damage)

- Texas: 30/60/25

- Florida: 10/20/10

- New York: 25/50/10

Caution with Minimum Coverage State minimums are often insufficient to cover serious accidents. Medical costs and property damage can quickly exceed these limits, leaving you personally liable for the difference.

When to Choose Liability vs. Comprehensive Coverage

When Liability-Only Makes Sense Your bike is older with low replacement value (under $3,000) You have substantial savings to replace your bike if needed Your motorcycle is not your primary transportation You ride infrequently or only in good weather You store your bike in a secure location

When Full Coverage Is Worth It Your bike is new or has high replacement value You're financing or leasing your motorcycle Your bike is your primary transportation You ride frequently or in all conditions You live in an area with high theft rates

Strategies for Sport Bike Owners

Sport bike owners face some of the highest insurance premiums, but there are specific strategies to reduce costs:

- Start with a smaller displacement bike - A 400cc sport bike can cost 50-70% less to insure than a 600cc+ model while still offering excellent performance.

- Take advanced rider courses - Sport bike-specific training courses can qualify for additional discounts while improving your skills.

- Install safety modifications - Frame sliders, ABS, and traction control can sometimes qualify for discounts at select insurers.

- Consider higher deductibles - Raising your deductible from $500 to $1,000 can lower premiums by 10-15%.

- Join a rider association - Organizations like the AMA offer insurance discounts to members.

- Motorcycle Insurance Specialist "Many sport bike owners make the mistake of getting quotes only from mainstream providers. Specialized motorcycle insurers like Dairyland and Markel often offer significantly better rates for high-performance bikes."

Finding Your Cheapest Bike Insurance: Comparison Checklist

Use this checklist when comparing motorcycle insurance quotes to ensure you're getting the best possible rate without sacrificing important coverage.

What information do I need to get accurate quotes?

Your motorcycle`s year, make, model, and VIN Your riding history and license information Details about where and how you store your motorcycle Your typical annual mileage Information about any safety courses you`ve completed Details about anti-theft devices installed on your bike

What coverage limits should I consider?

While state minimums offer the cheapest premiums, most experts recommend at least: Bodily injury: 100/300 ($100,000 per person, $300,000 per accident) Property damage: $50,000 Uninsured/underinsured motorist: Same as bodily injury limits Comprehensive/collision: With deductibles you can afford if needed

How can I accurately compare quotes from different providers?

Ensure all quotes have identical coverage limits and deductibles Check if quoted rates are monthly or annual (some companies advertise monthly rates while others quote annually) Verify what discounts are already applied to each quote Ask about potential additional discounts not automatically included Consider the financial strength rating of each insurer (A.M. Best rating)

Conclusion: Balancing Cost and Coverage

Finding the cheapest bike insurance requires understanding the factors that affect your rates and strategically leveraging discounts and coverage options. While Dairyland, Progressive, and Harley-Davidson consistently offer the lowest rates nationwide, the best provider for you depends on your specific circumstances. Remember that the cheapest policy isn't always the best value. Consider the financial protection you need based on your bike's value, how often you ride, and your personal risk tolerance. By comparing quotes from multiple providers and applying the strategies outlined in this guide, you can find affordable motorcycle insurance that provides the protection you need without overpaying.

Related Articles

Popular Posts